Depreciation calculation example

Annual depreciation cost residual value year of useful life. Since it is a special type of depreciation it is not the same as the subsequent years depreciation.

Depreciation Rate Formula Examples How To Calculate

Likewise the depreciation expense of machine using the declining balance can be calculated as below.

. The accumulated depreciation is taxed as ordinary income and the remaining amount in the realized gain is taxed as a capital gain. Depreciation calculation example Rabu 07 September 2022 Edit. Determine the useful life of the asset.

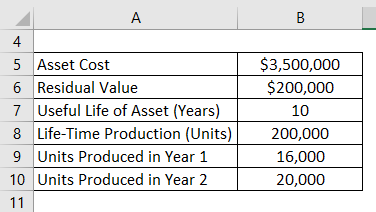

Units of production depreciation Number of units producedLife in number of units x Cost Salvage value Example. Depreciation is the amount the company allocates. The total number of units that the asset can produce.

Bonus Depreciation is calculated by using the bonus rate which is prevailing in the market. A Sample Depreciation Calculation In this insurance depreciation example the thing was damaged when it was 2 years old and currently costs 250 dollars to replace including tax. Depreciation rate 1 Assets useful life x 100.

Depreciation per year Asset Cost - Salvage. Divide the sum of. Book value Cost of the asset accumulated depreciation.

Multiply the rate of depreciation by the beginning book value to determine the expense for that year. Depreciation recapture Accumulated depreciation. Suppose if the cost of a motor is rs20 000 its useful life is 4 years and scrap value is Rs2000 the annual.

A company buys a press for INR 50000 that can. For example the first-year. Depreciation 2 Straight line depreciation percent book value at the beginning of the accounting period.

For example 25000 x 25 6250 depreciation expense. Therefore the calculation of Depreciation Amount using Straight-line Method will be as follows Using Straight-line Method Cost of Asset- Salvage Value Useful Life of Asset 15000. The most common depreciation is called straight-line depreciation taking the same amount of depreciation in each year of the assets useful life.

Year 1 depreciation 20000 x 40 8000 Year 2 depreciation The net book value of. The formula for this type of depreciation is as follows. With this method the depreciation is expressed by the total number of units produced vs.

This rate then goes into various depreciation. Subtract the estimated salvage value of the asset from the cost of the asset to get the total depreciable amount. Once calculated companies use the same rate for each asset in that class.

Depreciation Formula Calculate Depreciation Expense

Depreciation Formula Calculate Depreciation Expense

Depreciation Methods Principlesofaccounting Com

Depreciation Formula Examples With Excel Template

Depreciation Formula Examples With Excel Template

Depreciation Expense Calculator Best Sale 57 Off Www Ingeniovirtual Com

How To Use The Excel Db Function Exceljet

Depreciation Calculation

Depreciation Formula Examples With Excel Template

Depreciation Formula Calculate Depreciation Expense

:max_bytes(150000):strip_icc()/straight-line-depreciation-method-357598-Final-5c890976c9e77c00010c22d2.png)

Depreciation Definition

Depreciation Formula Examples With Excel Template

How To Use The Excel Amorlinc Function Exceljet

Depreciation Formula Calculate Depreciation Expense

Annual Depreciation Of A New Car Find The Future Value Youtube

Depreciation Expense Double Entry Bookkeeping

Depreciation Rate Formula Examples How To Calculate